What Bidvest’s Eurobond tells us about the maturation of SA’s Debt Capital Market

The international high-yield bond market functions as one of the largest and most technically evolved sources of corporate funding in the global financial system. Its depth runs into the trillions and its instruments are traded across jurisdictions and currencies, forming a continuous flow of capital between borrowers seeking long-term funding and investors seeking returns on their capital. Victor Germeshuizen, Senior Investment Banker, Absa CIB and Simon Rankin, Head of Internation Syndication, Absa Securities explain.

For emerging markets, and for Africa in particular, participation occurs almost entirely within the non-investment-grade segment – the continent’s composite rating profile setting a narrow ceiling that limits how far even the strongest corporates can compress their spreads.

Capital in this market is also controlled by a core of institutions whose portfolios define liquidity conditions for everyone else. That concentration of decision-making power is only part of the barrier to entry; the disclosure burden and the legal work required to bring a transaction to market introduce an additional layer of cost and scrutiny that not every issuer is prepared to absorb. For listed corporates, disclosure is largely embedded in their existing reporting rhythm, but for others the diligence, documentation, and external legal fees can be significant enough to deter potential issuers who might otherwise qualify on credit strength alone. Only a limited number of African corporates therefore manage to issue internationally with relative regularity.

Which is why Bidvest’s re-entry into the market is so significant.

In September this year, the company executed a dual-track liability management and refinancing exercise through its UK subsidiary, combining a new eurobond issue with a concurrent tender offer. Absa served as global coordinator and bookrunner, leading marketing strategy, investor engagement, and distribution alongside the international syndicate.

The strategy formed part of a broader debt reprofiling exercise, aimed at extending the group’s maturity profile and reducing short-term refinancing risk. Bidvest had an existing $478m bond maturing in 2026, and rather than carry both instruments simultaneously and absorb the associated cost of carry, the company structured the new issue to coincide with the repurchase of a substantial portion of the old one. The new $500m issuance, due 2032 on a seven-year non-call-three basis, effectively refinanced the previous issuance while establishing a fresh benchmark maturity. The transaction opened with initial price thoughts around the 6.75% area, but as the orderbook grew past $2.4bn, guidance tightened to 6.375%. Final pricing cleared at 6.20% on peak demand of roughly $2.8bn, an oversubscription of more than 5.5 times. The notes priced at a 40 basis-point spread over the South African sovereign curve, among the tightest differentials recorded for a sub-investment-grade corporate from the country.

The transaction demonstrated that South Africa’s corporate credit can still clear at competitive levels even in a high-rate, risk-selective global environment. It also marked the first major non-mining USD-denominated corporate eurobond from South Africa since 2023, underscoring the ability of an industrial issuer to access benchmark funding offshore.

Although Bidvest’s operations are increasingly international, roughly three-quarters of its earnings are domestic, which anchors its pricing to the South African sovereign curve. For any South African issuer, the sovereign yield serves as the functional baseline, and performance is judged by how tightly the spread can compress above it. Historically, leading corporates have cleared between 80 and 200 basis points over the sovereign, but Bidvest’s 40 basis-point outcome redefined that range, signalling that investors were willing to price the company’s credit quality and execution discipline almost at a quasi-sovereign level.

Part of what drove that success was scarcity.

South African corporates access the international bond market infrequently, often no more than a few transactions each year, which creates pent-up demand among global investors for credible South African paper. When an issuer of Bidvest’s scale appears, liquidity that has been waiting for a reference point tends to converge quickly, producing the kind of oversubscription seen in this book. The demand was visible not only in volume but in the quality of orders: long-only real-money accounts that anchor pricing rather than chase yield.

Equally important was the participation of domestic investors. South African institutions have traditionally stayed peripheral to international bond placements, constrained by mandates and currency considerations. This time, several entered the book in size, bidding competitively alongside global accounts. Their involvement strengthened price tension during the build and contributed materially to the spread compression that defined the outcome. It also demonstrated that the boundary between local and offshore capital is beginning to thin, allowing African investors to influence the pricing of their own corporate risk in global markets.

It all sends a powerful message to corporates, both in South Africa and across the continent, that well-structured and well-positioned transactions can deliver exceptionally cost-effective funding solutions on terms that rival those available in developed markets. It proves that debt capital markets can serve as a highly competitive alternative to traditional lending, offering access to deep, stable pools of capital that can finance expansion, acquisition, and integration for African issuers who prepare thoroughly and communicate their credit story with precision.

As African corporates continue to expand beyond their domestic markets, sustaining access to global investors is critical. The bond market offers a scale and speed that conventional bank lending cannot always replicate, and that efficiency, combined with the depth of capital now available to disciplined issuers, positions the debt capital markets as an increasingly integral component of how Africa’s leading corporates finance long-term growth.

Crypto in 2025: the year in review

As 2025 draws to a close, the cryptocurrency industry can look back on a year that fundamentally redefined its relationship with traditional finance. Rather than operating in parallel to conventional markets, digital assets have begun to integrate into mainstream financial infrastructure.

Price milestones

Bitcoin’s performance throughout 2025 reflected maturation rather than speculation. The digital currency topped R2 million on Luno for the first time on 20 January – Trump’s inauguration day – just 11 months after crossing the R1 million threshold. The asset continued its ascent, climbing above R2.2 million before October brought significant volatility.

The most notable correction came in early October when tariff announcements triggered a sharp decline to the current R1.47 million. Yet even this downturn revealed something important: the market’s response differed markedly from previous cycles. Institutional participation has fundamentally altered volatility patterns, leverage structures, and price resilience, creating a more stable – if still dynamic- trading environment.

Institutional adoption

No development better exemplified crypto’s mainstream moment than BlackRock’s IBIT Bitcoin ETF becoming the third-highest-revenue-generating fund in the asset manager’s portfolio of over 1,000 ETFs in less than two years. This represented more than just strong performance; it signalled that major financial institutions view cryptocurrency as a core rather than a peripheral offering.

The integration extended beyond investment products. JPMorgan, Visa, and Stripe deployed cryptocurrency technology for value transfer. Discovery Bank became the first bank in Africa to integrate crypto asset trading directly into its mobile banking application through its partnership with Luno, making digital assets accessible through familiar banking interfaces.

JSE-listed Africa Bitcoin Corporation’s decision to add Bitcoin to its treasury demonstrated that institutional interest has taken root locally, not just internationally.

Regulatory progress

South Africa achieved a significant milestone in October when it was removed from the FATF grey list. Strengthened Financial Intelligence Centre powers and new beneficial ownership disclosure requirements have positioned the country favourably for the continued growth of the crypto industry within a robust compliance framework.

A May 2025 South African High Court ruling clarified that existing exchange controls exclude cryptocurrencies, prompting calls for swift regulatory updates. Classifying digital assets like Bitcoin as ‘onshore’ when held on licensed local platforms could unlock institutional investment, potentially generating R500 million in tax revenue while allowing ordinary savers modest crypto allocations through funds.

While the United States considers allowing Bitcoin into workplace pension plans covering over 90 million Americans, South Africa continues to debate whether collective investment funds can hold Bitcoin at all, and risks falling behind.

In the United States, 2025 marked a policy turning point. Presidential executive orders created a more accommodating regulatory framework and directed the evaluation of a national digital asset stockpile. The June passage of the GENIUS Act (Guiding and Establishing National Innovation for US Stablecoins Act) established clear guidelines for the issuance of stablecoins by banks and companies.

The SEC initiated significant policy overhauls in September, including consideration of crypto trading on national securities exchanges. New leadership signalled fundamental shifts in regulatory philosophy, with Commissioner Paul Atkins suggesting updates to laws that hamper the development of decentralised finance.

Tokenisation trends

The line between traditional and crypto-native finance grew increasingly difficult to discern in 2025. BlackRock tokenised US bonds on Ethereum. Banks explored issuing their own stablecoins. Most significantly, Nasdaq proposed to the SEC that it be allowed to trade tokenised stocks on its exchange—potentially making one of the world’s largest traditional exchanges a venue for blockchain-settled securities.

Luno introduced over 60 tokenised US stocks and ETFs in South Africa, allowing 24/7 trading without currency conversions. These blockchain-based tokens represent ownership of traditional company shares, backed by shares held in custody, with prices that track the underlying stock values in real time.

McKinsey research estimates that by 2030, between $2 trillion and $4 trillion in assets could be tokenised and traded on-chain, providing round-the-clock market access and reducing friction for everyday investors.

Stablecoin adoption

Stablecoins, which meet the definition of a financial product under South Africa’s Financial Sector Regulation Act as digital representations of fiat currency, continued gaining adoption throughout 2025. Beyond the US dollar, other fiat currencies, including the Euro and South African Rand have been tokenised, reshaping cross-border payments and remittances.

In African markets, stablecoins serve practical purposes: business payments, inflation hedging, protection against currency depreciation, and retail transfers. SWIFT has announced plans to integrate crypto rails for 24/7 cross-border transfers using tokenised value signals, a move that even traditional financial infrastructure recognises as delivering efficiency gains.

2026 outlook

Several factors suggest continued momentum into 2026. Continued regulatory clarity and accelerating institutional adoption may test new market dynamics.

The critical variables will be global economic conditions, particularly trade relations and the evolution of monetary policy. Yet the fundamental question has shifted: the conversation is no longer whether crypto will integrate with traditional finance, but how quickly.

Additional themes emerged in 2025 that will likely shape developments in 2026. The total crypto market capitalisation crossed $4 trillion for the first time, though this remains modest compared to gold’s $30 trillion or the S&P 500’s $58–$62 trillion, suggesting substantial room for growth.

Decentralised AI networks emerged as potential solutions to concerns around ownership, security, and monopolisation in artificial intelligence. Projects like Helium and Bittensor demonstrated how crypto incentives can distribute workloads and build collaborative AI ecosystems.

Privacy-focused protocols have also matured, with industry discussion shifting from whether privacy belongs in crypto to how it can coexist with compliance, audits, and lawful oversight for legitimate use cases such as salary payments, business transactions, and confidential donations.

The year ahead

The cryptocurrency industry that emerges in 2025 will look markedly different from the one that entered it. Integration with traditional finance has progressed from possibility to reality. Institutional participation has reshaped market dynamics. Regulatory frameworks are becoming more sophisticated. The use cases have expanded beyond speculation to include genuine financial infrastructure improvements.

As we move into 2026, the industry’s challenge will be building on this foundation while maintaining the innovation and accessibility that made cryptocurrency compelling in the first place.

Invest globally with ease

For South Africa’s investors, the ability to access global markets has never been more essential. Yet for all its strategic importance, offshore investing has often been fragmented, costly, and time-consuming.

As priorities shift and digitally empowered clients expect more streamlined experiences, private banks are under pressure to offer more than conventional portfolio management. Today’s investor wants a platform that delivers control, efficiency, and global reach without sacrificing expert support.

In response, Nedbank has launched its enhanced international stockbroking platform; a fully integrated solution that allows clients to manage both local and international portfolios through a single, intuitive interface. The launch reflects a growing demand among experienced investors for tools that combine convenience, transparency, and seamless execution – whether they’re acting on real-time local opportunities or diversifying across borders.

“Global diversification is no longer a distant ambition; it’s an accessible reality,” explained Grant Meintjes, Executive of Trading at Nedbank. Speaking at the platform’s official launch event, he pointed out that by combining education, seamless access, cost-efficiency, and expert advice, Nedbank is not just facilitating investment; it’s empowering its clients to take ownership of their financial destiny.

Developed in partnership with international trading powerhouse Saxo Bank, the platform brings world-class capabilities to their private and wealth clients packaged in a way that feels personal and easy to use. While the technology was developed by external experts, the functionality is anything but off-the-shelf. Investors can access real-time data, execute direct transactions, and analyse market opportunities all from one place.

Key features of the platform include the following:

- No minimum investment amounts, which opens the door to more clients starting their offshore journeys.

- Dual-market access, which enables users to trade locally and offshore without switching platforms.

- Transparent fee structures that offer competitive pricing and no hidden costs.

- Fast, 48-hour onboarding that makes it quick and painless to start investing.

- Access to local stockbrokers who offer expert guidance alongside digital tools.

- A clean, user-friendly interface that offers intuitive navigation, real-time market data, and company logos for easier recognition.

To support the platform’s rollout, Nedbank has also invested in a robust educational campaign to demystify offshore investing. This includes content that explain how global markets work, highlight the cost benefits of investing offshore, and show how the platform makes it all easier.

But what truly sets the international stockbroking platform apart is its ability to handle both local and international trades through a unified system, eliminating the need for multiple accounts or complicated workarounds.

According to Meintjes, by the middle of 2026, the offering will expand further to include offshore mutual funds and bonds, which are products that are not commonly available on other stockbroking platforms.

“This platform is more than just a digital upgrade; it’s part of a broader strategy to shift wealth management from a closed-door experience to an empowered, client-led journey,” Meintjes emphasises. “The future of wealth management belongs to those with the vision to embrace and drive it, and with this new platform, Nedbank is handing the keys over to its clients.”

Discover Nedbank’s new online stockbroking platform here.

Ashburton Investments’ upward growth trajectory

Ashburton Investments has shown remarkable growth in the past financial year, with assets under management (AUM) increasing by 11% — an increase from R138 billion in 2024 to R154 billion in 2025, mainly from net positive inflows of R12 billion.

Mill Makanda, Chief Operating Officer (COO) of Ashburton Investments, believes the asset manager’s strong growth in the future would continue to come from its well-known Fixed Income track record.

“Traditionally, we have been known as a Fixed Income house, because of a very solid track record in this regard, which we want to continue. In the future I also foresee positive growth contributions coming from other parts of the business, most notably our Multi Asset portfolio, our offshore solutions, and tailored solutions such as new feeder funds to meet specific client needs,” says Makanda, who is also the Managing Director of the Ashburton Management Company.

It is important that the market realises that Ashburton Investments is in fact “an all-rounder with several strong teams” and a “solutions house rather than simply a product house”, he explains.

Ashburton’s three top performing funds

In the past financial year, ending in June 2025, Ashburton’s top three funds were Fixed Income funds, namely the Ashburton Stable Income Fund, which has R29 billion in AUM, the Ashburton Money Market Fund, with R21.6 billion in AUM, and the Ashburton Core Plus Income Fund at R11.4 billion. Another strong performer was the Ashburton Targeted Return Fund, which is sitting at R1.8 billion.

The continued growth of its funds places it within the top five fastest-growing asset management companies in South Africa, growing above 20% per annum compounded, over the last six years, relative to the industry’s 12% annual growth rate. Two out of three of its funds ranked in the top two quartiles relative to peers over the past year.

Recent case studies on Ashburton’s solutions-based thinking

Ashburton Investments recently assisted a mining client who needed to put money aside for future environmental rehabilitation, as part of its Environmental, Social and Governance (ESG) objectives. Ashburton’s Liability-Driven Investments (LDI) team stepped in to craft a tailored solution to protect and grow the client’s multi-billion investment.

It also recently assisted a corporate client who faced the challenge of having a large US Dollar portfolio offshore, which it wanted to derisk. Another pension fund client, in turn, wanted to take billions offshore to protect its clients against the Rand volatility.

“Ashburton can solve problems like these through its Dollar-denominated products, capabilities in Luxembourg, and through its international investment powerhouse partner, Morgan Stanley Investment Management (MSIM). We have multiple capabilities, local and offshore products, and a solutioning mindset, which means clients don’t need to go to various asset managers to solve different parts of the same problem. We can solve it.”

Looking to the future

Looking to the future, Makanda expects the company to continue to do well with corporate and institutional clients.

“Ashburton’s recent growth trajectory demonstrates consistency and discipline in our investment process,” he says. “It also reflects our commitment to delivering both sides of the coin – return on capital and return of capital.”

Alternative investments moved from niche to mainstream in 2025

This year confirmed that alternative investments are now too big and too important to ignore. McKinsey’s Asset Management 2025 report identifies ‘The Great Convergence’ between traditional and alternative asset management as the industry’s dominant theme over the next five years, with the high-net-worth segment ($1 million+ in investable assets) expected to drive much of that shift.

PwC’s research agrees – the firm projects that alternatives will outgrow both mutual funds and institutional mandates over the next five years. Even traditional giants are pivoting. In his latest annual investor letter, Larry Fink, Chairman and CEO of BlackRock, states: “BlackRock has always had a foot in private markets. But we’ve been, first and foremost, a traditional asset manager. That’s who we were at the start of 2024. But it’s not who we are anymore.”

The shift to alternative investments

The numbers tell a similar story:

- High-net-worth allocations to alternatives have grown from an average of around 3% a decade ago to 16% today [1]

- This is expected to continue to increase. As an example, Bank of America now recommends a 25% alternatives allocation for its high-net-worth clients

- This remains well below the current family office average of between 44 and 54%, depending on geography.

Advisers are moving just as rapidly. A September 2025 survey by AssetMark found that 91% of advisors believe that private market access is now essential for differentiation. Of the advisers who currently do not allocate, 68% plan to begin allocating within the next 12 months.

Private markets lead the way

As AssetMark’s CEO, Michael Kim, put it: “Private markets are no longer optional – they’re a strategic necessity.” Globally, approximately 88% of companies are private[2]. Companies are staying private far longer (the average age at IPO has risen from eight years in 2004 to 14 years in 2024). In the listed markets, the Magnificent Seven now account for around 35% of the S&P 500’s total market cap. The reality is that the public investment universe is small and becoming increasingly concentrated and correlated.

Interestingly, while illiquidity is often framed as a drawback, global private equity firm Permira finds that the illiquidity and long-term time horizon inherent in alternatives drives significant outperformance relative to public markets. This differential gets larger the longer the time horizon is extended.

Mainstream adoption and therefore capital flows have, of course, brought fierce competition and compressed returns in large-cap private markets. For this reason, Westbrooke has stayed disciplined in our lower- and middle-market focus, where capital is less available, pricing remains attractive, and there are still opportunities to focus on capital preservation while earning asymmetric returns on the upside.

For over 20 years, we have developed a proven, robust global investment process and platform, investing our own and our clients’ capital through multiple cycles and macro conditions. This platform gives our clients unique access to the long-term compounding potential that only aligned, experienced, and disciplined private-market investing can deliver.

Westbrooke’s 2025 investment statistics

Westbrooke now manages R16 billion ($935 million), with our shareholders and management our single largest investor, ensuring complete alignment.

Our investment activity for 2025:

- Transactions completed: 49

- Deployed: R4.6bn

- Exits (incl. refinancing): 37

- Exited: R2bn

The rigorous implementation of the Westbrooke Investment & Risk Philosophy and Approach has resulted in our historic annualised loss ratio through all cycles (including the global financial crisis, Brexit, state capture, Covid, multiple geopolitical challenges, wars as well as high interest rate environments) amounting to less than 0.1% p.a. This is over a 21 year track record where we have invested R22 billion (nominal amount not adjusted for inflation) across 560+ transactions.

The future of alternatives

Westbrooke’s offering spans private debt, private equity, hybrid capital, real estate and tax-enhanced investing across the UK, South Africa and the USA. We provide clients with a gateway to private market opportunities which are typically hard to access, enabling them to move toward the 25%+ private market allocations now common among sophisticated investors globally.

[1] Capgemini, 2025

[2] Companies with revenue of $100m+. BlackRock, 2025

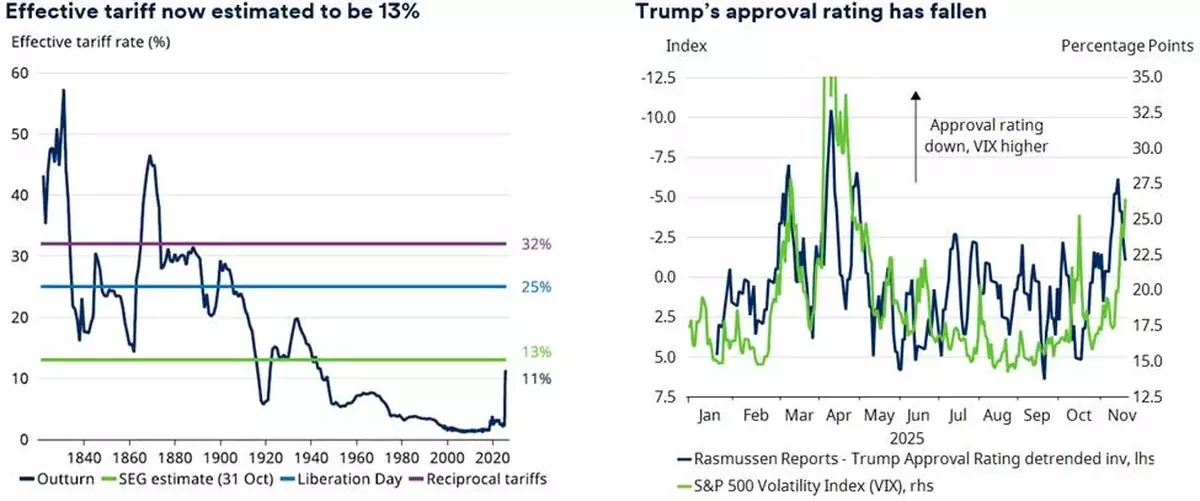

Outlook 2026: Take an active approach to valuation risk and seek opportunities to diversify

As we head into 2026 there is a lot of concern about equity market valuations. Comparisons are being drawn with the dotcom bubble of 1999-2000 due to significant investments being made by the hyperscalers into data centres and cloud infrastructure. At the same time many AI start-ups are loss making, with their valuations being boosted by vendor financing. Against this backdrop we’ve heard talk about canaries in coal mines, cockroaches (where one emerges there are usually many) and staying at the party for one last dance.

But let’s leave analogies to one side and focus on our options.

Firstly, equity valuations are expensive. They have been more expensive in the past and are not at extremes yet, but you could argue for taking some risk off the table. For example, if you run a mature defined benefit pension plan, you might be able to accept a lower rate of return at this point and bank some profit.

Most investors are not in this camp, however. There are costs to sitting on your hands: inflation needs to be outrun to preserve the value of savings and, with limits on how much one can save, money has to be worked hard to deliver the funds required for retirement and other goals. You need a plan for the possibility that you could be waiting a long time for a correction and the golden buying opportunity.

The passive option is to stay invested in an equity index. Over the long term (20 years), history shows that equities deliver a decent return, particularly if fees are kept as low as possible to aid the compounding of those returns. The challenge with this approach is that, due to the concentration of equity indices in a small group of technology companies, you are particularly exposed to the equity valuations which everyone is so worried about. There is also significant idiosyncratic stock risk, if anything should go wrong with one of these large holdings.

I worry that not all investors realise how concentrated their exposure is. It is not always clear, in the case of passive investment, who oversees that risk for them.

Alternatively, you can try to risk manage the situation. As active investors, we take calculated risks based on a broad range of factors, knowing that over time our clients need a return. Looking at market valuations, we think that equity markets are still supported by the fact that bond yields are well-behaved, inflation is quiescent for now, and central banks are likely to ease a bit more. Over the medium term, I am concerned about mounting government debt levels and the potential for inflation to accelerate, leading to higher discount rates, but over the next six months this risk is low. We also see low risk of US recession: although the labour market is softening, unemployment is still low and private sector balance sheets are in good shape. So, at market level, we still see positive returns from equities.

There is the question of stock-specific risk, which I raised above, but we still see the potential for the hyperscalers to deliver revenues. We are monitoring the return on investment of these mega cap companies as they have evolved from free cash flow monsters to big spenders, and we are also watching the performance of large language model and cloud computing companies as a reflection of the adoption of the new technologies.

The bottom line is that we still see opportunity at stock level. Critically, we take this risk deliberately, backed by detailed fundamental analysis, rather than because of the weight of a stock in the index.

Finally, we are finding opportunities for diversification. It hasn’t been all about AI. 2025 has shown the benefit of geographical diversification and Value has performed outside the United States. Emerging market debt offers better dynamics and higher real yields than developed market debt. There are also opportunities to generate income from diversifying investments such as insurance-linked securities and infrastructure debt. Liquid hedge fund strategies could also offer a means of increasing diversification whilst remaining invested.

As active investors, we don’t have the luxury of talking in vague terms about risks on the horizon. We have to take a view. For 2026, we see a low risk of recession, contained bond yields and momentum in company earnings which leads us to stay positive. Our processes are designed to recognise quickly if our views change or if we get it wrong, so that we can adapt and adjust our strategy.

The waters are getting choppier, but we still see ways of navigating them to get to our destination. It is too soon to seek shelter.

Top insurance tips this festive season

With the holidays just around the corner, many South Africans are starting to feel the festive cheer. But although this is a time for celebration, it also brings higher risks for your clients, including increased crime levels. Tarina Vlok, MD of Elite Risk Acceptances, a high-net-worth insurer and a subsidiary of Old Mutual Insure, shares her top tips for staying safe this festive season. Now is the time to share them with your clients.

According to reports, crime rates on average increase by an estimated 20% to 30% during December and January. House break-ins also spike, with some data showing as much as a 48% increase in December alone when homes are left empty by holidaymakers.

“The jingle reminds us that ‘tis the season to be jolly as we approach our holiday gifting through shopping at stores or online, and many times, in search of the best deals. However, there are also some dangers that opportunists hope to capitalise on. With some awareness, you can reduce your risk of becoming a target,” says Vlok.

Insure your purchases

Vlok says that with many shoppers chasing year-end deals, it’s essential to think about the insurance implications. Deloitte’s Holiday Retail Survey shows consumers are prioritising good value, with top spending categories including clothing and accessories (76%), electronics (56%), and toys and hobbies (52%).

Vlok cautions that buying items on special can inadvertently leave you underinsured. “If you pay R13,000 for a SMEG stove but its replacement value is R24,000, you may be underinsured if you claim,” she explains.

She recommends consumers to adjust their insurance cover over the holiday period. “If you buy R100 000 worth of appliances on Black Friday, you need to increase your household-contents insurance by the same amount,” she says.

It’s also best practice to notify your insurer or broker of any high-value purchases and to provide invoices. “Clients often call to say they’ve bought an expensive dining-room table or an engagement ring and need extra cover,” she comments. “That way, if there’s a break-in or theft, they’re not out of pocket.”

Be cautious when shopping

Extra caution is needed when shopping, especially as criminals take advantage of busy malls and distracted customers. “When you park your car, make sure it’s locked. Even if it sounds simple, you’d be surprised to know how many consumers don’t realise they have left them exposed,” urges Vlok. “Check your door handle to ensure you haven’t been remote-jammed.”

She also recommends placing all purchases in the boot: “Don’t advertise what you’ve bought by leaving bags on the back seat. And remember, if someone breaks in and the items were visible, you may have a challenging time to claim back from your insurer.”

The Deloitte Holiday survey also finds that Gen Z is turning to social-media influencers and ChatGPT for gift inspiration. With this in mind, Vlok warns against oversharing online. “Avoid posting pictures of new valuables like a Rolex on Instagram,” she cautions. “And never geotag your location – criminals can use that information to track you.”

House and car tips

For homeowners travelling these holidays, ensure your alarm is working and activated before you leave. “If your area has heavy summer rain, clean your gutters before going away,” says Vlok.

Holidaymakers driving long distances should have their car serviced and check tyre treads. Vlok also emphasises road safety basics: “Don’t look at your phone while driving and stop regularly to stretch your legs.”

If you’re attending a function and expect to overindulge, arrange safe transport home. “Many insurers may offer a ‘drive me home safely’ service for big nights out; it is a good idea to check with your insurer and take advantage of the service,” she adds.

Taking a few simple precautions goes a long way towards a stress-free holiday. “Safeguarding your home, car and valuables ensures a safer and more enjoyable festive season,” Vlok concludes. “Then you can focus on what truly matters – spending quality time with loved ones.”

South African employers can make a difference in 2026

PwC Strategy&1 is pleased to share its latest South Africa Economic Outlook report, entitled “South African views on the cost of living, economic stability, health, and climate change: Insights from PwC’s Voice of the Consumer Survey 2025”.

The recently published Voice of the Consumer Survey 2025 explored the macro factors that South African consumers believe could have the greatest impact on the country in the near future. Top concerns identified for 2026 are the cost of living, economic instability, health risks, climate change, social inequality, food insecurity and environmental damage.

In PwC’s December 2025 economic outlook report, the four top concerns are unpacked in more detail. How these impact employee wellbeing? Importantly, the report also looks at what employers can do to support their employees with these challenges.

Lullu Krugel, PwC South Africa Chief Economist, says:

“The South African economy is driven by household expenditure. However, consumers are looking at 2026 with concerns about their cost of living, economic instability, health risks and climate change. While none of these trepidations are new, the imperative for employers to support their workers with these challenges has never been greater. Focusing on the wellbeing of the employee has tangible financial and other benefits for companies, and supports the stability of local communities where employees and their families live.”

Addressing the cost-of-living challenge

While some headline data (like monthly inflation and income indicators) suggests that South African consumers have it a bit easier right now compared to recent history, the cost of living is still too steep for most people. For example, a four-person household receiving one minimum wage income does not have enough money to afford a nutritious diet after transport and electricity costs are deducted. Due to employment and income constraints, one in five South Africans are considered moderately or severely food insecure.

To address the cost-of-living challenge, South African companies need a clear understanding what employees need to cover costs for housing, basic nutrition, transport and healthcare. This calls for in-depth research into what a living wage would be, moving beyond national averages to understand what employees really need, and integrating these insights into strategic workforce planning. Although somewhat ‘out of fashion’, geographic pay differentiation deserves consideration as well. A living wage in Polokwane, for example, where the average free-standing house price is around R1.3 million, differs substantially from Sandton (with a mean of R3.3 million) and Tembisa (average of R700,000).

Businesses should consider the triple bottom line – people, planet and profit

South Africa’s real GDP per capita declined by a cumulative 4.2% over the past 10 years. A drop in this metric is generally associated with declining standards of living and economic instability. South Africans feel the impact of economic instability at the community level where associated issues like poverty, inequality and unemployment result in many social challenges like crime and declining societal trust.

These conditions also adversely affect interpersonal trust within communities. Social trust is a deep determinant of economic progress: it fosters cooperation, reduces transaction costs and encourages investment and innovation. When individuals trust each other, they engage in mutually beneficial exchanges, leading to economic growth and development. However, according to the World Value Survey, only one in four South Africans believe that most people in the country can be trusted.

Often, companies are focussed on their main bottom line (profit) when making business decisions. Instead, we advocate for businesses to rather consider the triple bottom line—people, planet and profit— that drives impact at the community level. Initiatives like supporting access to basic services (healthcare, recycling projects, etc.) can provide for greater community stability (healthier children, less litter, cleaner air, etc.) during times of economic instability.

Alinah Motaung, PwC Africa People Leader, says:

“Employee wellbeing is a shared responsibility. Employers play an important role in supporting the health of their people across seven dimensions of wellbeing: physical, emotional, intellectual, mental, spiritual, financial and social. These are proven drivers of performance, fulfilment and engagement. When corporate wellbeing practices are combined with individual commitment to healthy behaviours and attitudes, it leads to a positive impact not only on the individual, but on their teams and client relationships.

“It is also essential for South African companies to understand, measure and communicate their overall impact on society as this promotes trust and loyalty among stakeholders, drives sustainable business growth, and contributes to the overall wellbeing of our people. When we consider socio-economic impacts, we look beyond just the jobs created by an employer. Other key considerations include the division (equity) of salaries and wages between low-, medium- and high-income households; payment of municipal and national taxes and the salaries (for doctors, teachers, etc.) that these finance; and the inclusion of local SMMEs in supply chains.”

Employers must support the wellbeing of their workers

South Africans are concerned about health risks like chronic illness, the cost of medicine, and mental health conditions, among other medical challenges. In 2025, they faced several key challenges that has (or could in the future) reduced their access to healthcare: high inflation on healthcare costs; interruption in HIV and TB treatment delivery due to funding disruptions from the US; and speculation about the reduction / elimination of medical aid tax credits.

Around 20 million South Africans do not have access to universal health coverage (UHC) due to multiple factors, including physical access and the cost of healthcare. Many of them expect their employers to do more to provide them with access to healthcare. Aside from directly funded healthcare benefits and contributions towards medical aid, other options for employers to support employee wellbeing include supporting physical fitness, providing preventative care, offering mental health services, and running in-house educational programs.

The impact of climate events

Nearly half of surveyed South Africans believe extreme weather events will impact their ability to do their job. A drought-induced lack of water supply would, for example, undermine water-intensive agriculture and mining. Heat stress can make it difficult or even life-threatening for mine and farm workers to do their jobs.

Climate analysts can identify physical climate risks at a granular level, i.e. at specific locations and for affected communities in a company’s value chain. This kind of location-specific analytical depth is required to understand heat stress at a specific location and for a specific set of employees. In some locations, elevated temperatures can cause heat-related illnesses, while in other areas heat changes could increase the risk of exposure to new vector-borne diseases.

Dr Christie Viljoen, PwC South Africa Senior Economist, says:

“It has never been more important to engage and listen to the workforce, cultivate a people-centric environment, and support what matters most to employees. If South African companies want to deliver growth and transformation in a world of exponential innovation and technological disruption, business leaders must take care of their workers. They need to continuously evaluate the skills they need, their approach to retaining talent, and the development of their existing workforce.”

1 Strategy& is PwC’s global strategy consulting business, and the only at-scale strategy business inside a professional services network.

Find out more at www.pwc.com.

A focus framework for financial advisers in the year ahead

In a world defined by constant noise, shifting markets and changing client expectations, financial advisers face the same challenge their clients do: staying focused on the goals that matter. Without clarity of purpose, it’s easy to get pulled into operational busyness instead of strategic progress, both for your business and for the households you advise.

At Momentum’s 7th Science of Success Festival, international change-management expert Dr Price Pritchett shared a four-point focus checklist that resonated strongly with the adviser community. His message was simple: focus is not a personality trait, it’s a discipline. And it’s a discipline advisers can use to strengthen their practices, sharpen client conversations and elevate long-term outcomes.

Below is a repurposed four-point framework, applied directly to the realities and responsibilities of today’s financial adviser.

1. Set a big, scary goal for you and for your clients

Pritchett emphasised that meaningful progress starts with ambitious goals that feel big enough to stretch both advisers and their clients. “Setting an ambitious goal sets the stage for everything that follows.”

For advisers, this applies on two levels:

• Your practice:

What is the bold, uncomfortable target that could redefine your growth in 2026? Is it expanding into a new client segment, adopting new technology, increasing recurring revenue, or formalising succession planning?

• Your clients:

Financial plans without a compelling end point lack power. Whether the goal is early retirement, intergenerational wealth transfer, or creating financial resilience, clients respond more strongly to meaningful long-term vision than to generic savings messages.

Pritchett also cautioned that sharing big goals too early invites doubt from others. Advisers can take this to heart by helping clients protect their early-stage ambitions and by building quiet momentum before external scrutiny sets in.

2. Pursue the goal relentlessly through structure, reviews and habit

Relentless pursuit doesn’t mean working harder; it means working intentionally. With nearly half of daily behaviour driven by habit, advisers who systemise their approach to planning, reviewing and advising create consistency that compounds over time.

For advisers, this means:

• Making annual and mid-year reviews non-negotiable, especially in an environment of rising costs, shifting tax considerations and unpredictable markets.

• Building forward-planning habits into your client conversations so households don’t wait for crises to reassess their circumstances.

• Helping clients develop habits that support their financial wellbeing, whether through automated savings, structured investment contributions or disciplined debt reduction.

The start of a new year is an ideal moment for advisers to refine their own processes and help clients do the same.

3. Do the mind work because your thinking drives your results

Mindset is often the silent differentiator between advisers who stagnate and advisers who scale. Pritchett highlighted that reducing negative thinking is even more powerful than trying to be relentlessly positive.

Advisers can translate this into practical value by:

• Challenging limiting beliefs, their own and their clients’. Many clients underestimate their ability to become debt-free, retire comfortably or build wealth. Advisers help reframe what’s possible.

• Reducing procrastination by guiding clients from “I should think about that” to “Let’s implement this.”

• Positioning professional advice as a catalyst, especially during major life changes such as marriage, bereavement, career moves, or the birth of a child.

Financial advice is as much about behaviour as it is about numbers, and the adviser’s role in navigating mindset is a powerful differentiator in a crowded market.

4. Track progress

John Doerr’s timeless line: “Ideas are easy, execution is everything” is particularly relevant to financial planning. A beautiful strategy means very little without disciplined follow-through.

For advisers, tracking progress is where trust is built:

• Portfolio reviews ensure alignment with client goals and help advisers demonstrate value beyond investment returns.

• Insurance and risk reviews highlight gaps and opportunities in protection strategies.

• Clear, measurable milestones keep both adviser and client accountable. Clients who see tangible progress stay engaged, committed and loyal.

The power of support, mentorship and professional partnership

Pritchett argued that no focus journey is successful in isolation. For advisers, this includes:

- Surrounding yourself with mentors and peers who challenge your thinking.

- Leveraging specialist partners in tax, healthcare, estate planning or investments.

- Positioning yourself as the expert support system clients rely on to stay focused amid financial distractions.

Success for both advisers and the households they serve is rarely a solo act.

From checklist to action

The insights shared at the Science of Success Festival underscored a powerful truth: discipline is the difference between distraction and direction. For advisers, this discipline looks like:

- Setting bold goals

- Pursuing them intentionally

- Doing the mindset work

- Tracking measurable progress

- Surrounding yourself with the right expertise

As Qhawekazi Mdikane, Head of Brand at Momentum, reminded the audience: we may inherit financial behaviours, helpful or harmful, but we all have the agency to choose new ones. Advisers play a crucial role in helping clients make those choices and modelling them within their own practices.

The new year offers advisers a chance to reset, refocus and re-energise. With clarity, intention and the right framework, 2026 can be a year of meaningful growth, for advisers and their clients alike.

Absa CIB leads National Treasury’s R11.8 billion infrastructure bond

Absa Corporate and Investment Banking (CIB) has executed National Treasury’s inaugural R11.8 billion Infrastructure and Development Finance Bond as Sole Lead Arranger and Infrastructure Finance Structuring Agent. The instrument supports the Government’s Budget Facility for Infrastructure (BFI) and is intended to mobilise long-term capital for priority public infrastructure projects.

Issued under the Republic of South Africa’s Domestic Multi-Term Note Programme, the transaction comprises two senior unsecured tranches – the RI2036 and RI2041 – both offering fixed, semi-annual coupon payments.

Infrastructure is a pillar for South Africa’s growth

“Infrastructure investment is foundational to South Africa’s long-term economic and social development,” said Koketso Morakile, Interim Head of Sustainable Finance at Absa Corporate and Investment Banking (CIB). “This transaction strengthens the alignment between capital markets and the country’s infrastructure priorities by enabling funding to flow towards nationally significant projects. We are pleased to support this milestone transaction and to contribute Absa CIB’s structuring expertise to the development of infrastructure-focused financing in South Africa,’’ Morakile continued.

South Africa’s National Development Plan identifies a 30% investment-to-GDP ratio as a critical benchmark for sustained growth, with public infrastructure investment playing a central role in meeting the country’s transformation and inclusive development objectives. Recent policy commitments, including over R1 trillion allocated to infrastructure over the medium term, underscore the importance of long-term, predictable financing in enabling the delivery of public assets across energy, transport, water, digital services, and social infrastructure.

Supporting disaster relief and future projects

In the 2025 Medium Term Budget Policy Statement, Finance Minister Enoch Godongwana confirmed that nine BFI projects had advanced to detailed analysis, including disaster-relief initiatives to repair schools, pipelines, clinics, and substations damaged by recent flooding in KwaZulu-Natal, Mpumalanga, and the Eastern Cape. Proceeds from the bond will be used exclusively to finance projects under the BFI programme.

“This transaction demonstrates how capital markets can be used deliberately to advance national development priorities. Our role was to ensure that the instrument was technically sound, appropriately benchmarked, and able to clear efficiently in the auction environment. It lays the foundation for future transactions of this nature,” said Marcus Veller, Head of South Africa Debt Capital Markets.

Capital markets driving sustainable development

Absa’s participation reflects the bank’s ongoing focus on mobilising capital that supports sustainable development and advances Africa’s growth trajectory. Through its Debt Capital Markets franchise, the bank continues to provide structuring, distribution, and execution capabilities that enable sovereign and public-sector clients to access efficient funding for critical investment programmes.

“The Infrastructure and Development Finance Bond represents an important step in how South Africa mobilises long-term capital for priority infrastructure. It establishes a platform for scaling development-focused financing and deepening investor participation in the country’s infrastructure agenda’’, concluded Morakile.

Financial inclusion is a human right

As we come to the end of the year and start to think about holidays and fun, it can also be a time of reflection. This year, Human Rights Day really brought home to me that dignity is not only about how we are treated, but also about whether we have real choices in our lives. We often talk about rights in terms of politics or social freedoms, but another right rarely gets the attention it deserves – the right to participate in the economy.

In South Africa, too many people still feel like the financial world was designed for someone else. The systems look complicated, the language feels like a password you were never given, and the starting points can feel more like barriers than invitations. When people are shut out, their opportunities shrink. And when opportunities shrink, so does the chance to build stability, wealth, and a future with options.

To me, financial inclusion is not something reserved for a fortunate few. It is a basic human right, one tied directly to dignity, fairness, and economic justice. For too long, participation in financial markets depended on who you knew, what you earned, or where you lived. That model belongs in the past. Inclusion starts with lowering the walls that keep ordinary people out.

That means making trading accessible without minimum deposits that intimidate new users. It means giving people a safe place to learn before they risk a cent. It means platforms that work on a cellphone as well as on a laptop, so location and income do not determine your future.

Access is just the first step. A person can be given the doorway, but if what waits on the other side feels confusing or intimidating, they will step back. That is why financial literacy is the foundation of real inclusion. People need learning tools that speak to them in a way that feels familiar and respectful. Sometimes that means using the languages they grew up with. Sometimes it means slowing things down and explaining concepts without assuming prior knowledge. Everyone deserves the chance to understand money without feeling judged, overwhelmed, or shut out.

At CFI, we take that responsibility seriously. We create multilingual learning content, run free webinars, and encourage people to practise in demo accounts because confidence begins with understanding. When people finally see how something works, when the pieces start making sense, they realise they can do more than they thought.

Technology should level the playing field

I hear people say all the time that the markets are too complicated or ‘not for ordinary South Africans.’ The truth is that technology has already changed that story. A well-designed platform can simplify things that once felt impossible. Tools that clearly show risk, explain why a decision makes sense, or break down how prices move can give first-time traders the confidence to take their first step.

And for me, the test of any platform is whether it helps people feel safer, more informed, and more in control. If it does not, then it is not serving them.

Partnerships make inclusion real

Inclusion cannot be delivered by one organisation. It takes a network of educators, community leaders, global partners, and local mentors working together to make learning accessible and trusted. We work with groups who share the belief that everyone deserves a fair chance at financial stability. When communities learn together, they rise together.

When people gain access to markets, they gain more than a trading account. They gain agency. They gain the ability to plan, save, invest, and make decisions that shape their children’s lives. To me, that is the heart of Human Rights Day. It is about giving every person the practical tools to build a life with dignity.

Three simple ways to take your first step toward financial inclusion:

- Join one of CFI’s free weekly webinars to get real-time market insights and education in plain language. These are designed to be beginner-friendly and offer space to ask questions.

- Create a free demo trading account on the CFI website. This lets you practise in a risk-free environment using real market data, so you can build confidence before committing any money.

- Visit the CFI Education Hub to access multilingual content, easy-to-follow guides, and videos created for everyday South Africans.

Inclusion is not an abstract ideal. It is a daily practice. And if we commit to it, we can shape a future where economic participation is not determined by background, but by ambition.

Helping clients make intentional financial decisions this festive season

As the festive season approaches, many South Africans shift into holiday mode, taking a break, travelling, celebrating and reconnecting with loved ones. But advisers know that December is also a month where financial discipline tends to loosen, budgets get stretched and long-term plans can easily go off track.

The pressure to spend, coupled with year-end bonuses, stokvel payouts and heightened social expectations, creates a perfect storm for impulsive financial decisions. This is especially concerning in a country where, according to the Momentum Group/Bureau of Market Research survey, households already spend around 77% of their income, leaving little room for error. When year-end spending escalates, January’s financial strain – “Janu-worry” – is almost inevitable.

For advisers, this period is an important opportunity to help clients reinforce the foundations of their financial plans. Siboniso Dlungwane, Senior Finance Business Partner at Metropolitan, notes a trend that advisers should watch closely: policyholders sometimes skip premiums to create short-term liquidity. “While this benefit exists to support clients through tough times, it’s essential they understand the long-term consequences, it may leave families exposed when they need protection most.”

Dlungwane adds that proactive planning can help clients avoid this. Metropolitan, for example, now enables customers to pay premiums ahead of time through convenient platforms such as WhatsApp and PayShap, an approach advisers can highlight when discussing year-end budgeting.

Below are key behaviours advisers can encourage to help clients stay financially resilient during the festive season:

1. Guide clients to balance year-end generosity with long-term stability

Bonuses and payouts often tempt clients to overspend. Help them allocate funds intentionally, setting aside a portion for savings or debt reduction before spending the remainder on festive celebrations. Highlight the value of vehicles such as growth funds or long-term savings plans that harness compounding.

2. Encourage clients to review and refresh their cover

Advisers should prompt clients to ensure policies – especially funeral cover – are up to date ahead of holiday travel and increased risk exposure. This includes checking premium status, updating beneficiaries and confirming access to important documents. Advisers can also clarify repatriation or transport benefits, preventing last-minute panic purchases during emergencies.

3. Reinforce good digital-security behaviour

With online shopping surging in December, clients are more vulnerable to cybercrime. Remind them of safe practices: using virtual cards, transacting through secure platforms and verifying communications from insurers. Advisers can alert clients to common scams involving fake policies or fraudulent payment requests.

4. Promote family-wide financial communication

Clients benefit when households understand shared goals, expenses and protection structures. Advisers can encourage clients to involve their partners or families in discussions and ensure everyone knows what policies are in place and why they matter. This strengthens financial resilience and reduces vulnerability during crises.

Ultimately, December is just one month but poor decisions made now can affect clients for the entire year ahead. Advisers play a crucial role in helping clients protect what truly matters: their long-term goals, their insurance cover and their overall financial wellbeing. With proactive guidance, clients can enjoy the festive season without compromising their financial confidence heading into 2026.

Electrifying equity: Reshaping investment opportunities in a changing world

Global markets are entering a period where shifts in power, technology and production are reshaping investment opportunities. We believe these turning points matter. They influence market cycles, redefine risk and create opportunities that transcend traditional sector categories.

At our recent Exhibiting Our Investment Artists webinar, Junaid Bray from Laurium Capital unpacked the structural forces driving change across global and South African equity markets. This is not a cycle driven by speculation; it is a decade-long rebuild of physical infrastructure, energy systems and production capacity.

A new industrial era, powered by copper

Copper is emerging as a central driver of this new industrial era. The rapid expansion of artificial intelligence (AI) and data centres is increasing the need for copper-intensive electrical systems, while the United States and Europe are beginning large-scale modernisation of ageing power grids. At the same time, global supply chains are shifting as production is reshored and regionalised and the electrification of transport, buildings and industry continues to gain momentum.

Within the Curate Momentum Equity Fund, this conviction is reflected through meaningful exposure to high-quality global miners such as Anglo American and Glencore.

Powering AI: The grid is ageing and demand is accelerating

While AI dominates headlines, the reality behind the technology is far more physical. Major technology firms such as Amazon, Microsoft, Google, Meta and Oracle are expected to invest close to half a trillion dollars yearly in AI-related capital expenditure. New data centres are being planned, built and connected across key global regions. These facilities consume up to four times more power than traditional servers. Regardless of how quickly AI evolves, the demand it creates is real and immediate. The world will require new transmission lines, substations and power-generation capacity to support the next chapter of data-driven growth.

Our approach: Electrification

To take advantage of these opportunities, Laurium Capital has been focusing on companies that provide the essential infrastructure behind AI, electrification and the modernisation of global power systems, including Quanta Services, GE Vernova, which recently separated from GE, Broadcom, and Siemens.

These companies reflect a focus on tangible enablers of global electrification and energy transformation, rather than on areas of the technology cycle that tend to be more sentiment-driven.

Back home: A strong but narrow South African market

While global structural shifts continue to shape international opportunities, South Africa’s equity market has also shown impressive performance. However, much of the rally has come from gold, platinum group metals (PGMs), major technology-linked counters such as Naspers and Prosus and the telecommunications sector.

Beyond these concentrated gains, the underlying backdrop in South Africa is steadily improving, supported by several encouraging developments:

- A stronger terms-of-trade environment driven by firm precious-metal prices and lower oil costs

- Moderating inflation and the prospect of further interest rate cuts

- Early progress in logistics reform, with increased private-sector participation

- Reduced electricity constraints

- Attractive valuations across banks, insurers and selected domestic cyclicals.

Against this backdrop, the Curate Momentum Equity Fund maintains a balance between exposure to commodities and high-conviction positions in South African financial, industrial and globally oriented businesses listed on the JSE.

Integrating global structural shifts with local opportunity

The Curate Momentum Equity Fund is designed to blend South Africa’s improving fundamentals with powerful long-term forces shaping global markets. By drawing on specialist research across both local and global sectors, the fund can identify structural changes early and position accordingly. This approach helps strengthen its resilience by reducing dependence on any single economic environment.

The fund reflects:

- High-quality opportunities within South African financial and industrial sectors

- Exposure to global electrification and large-scale infrastructure investment

- Access to copper, power and technology-driven developments that are not readily available in the local market

- A disciplined, fundamentals-based investment style.

Looking ahead

We are entering a period of profound global realignment, where power systems, data infrastructure and industrial production are being rebuilt at a scale last seen in the early industrial eras. Although AI continues to dominate headlines, the more transformative story is unfolding in the physical world: copper supply, electricity grids, substations, turbines and the advanced components needed to support accelerating digital demand.

The Curate Momentum Equity Fund is positioned to reflect these long-term shifts by combining deep local insight with global structural exposure, creating a balanced approach designed to navigate multiple market environments.

We believe investors should have access to opportunities driven by these fundamental changes through carefully constructed, disciplined and research-led investment strategies built for the long term.

For more information on the Curate Momentum Equity Fund, click here.

This document has been prepared by Curate Investments (Pty) Ltd (Curate). Curate is an authorised financial services provider (FSP No. 53549) under the Financial Advisory and Intermediary Services Act, 37 of 2002 (FAIS). This is a marketing communication. Collective investments are generally medium to long-term investments. The value of units may go down as well as up and past performance is not necessarily a guide to the future. Collective investments are traded at ruling prices. Commission and incentives may be paid and, if so, would be included in the overall costs. All performance is calculated on a total return basis, after deduction of all fees and commissions and in US dollar terms. Higher risk investments include, but are not limited to, investments in smaller companies, even in developed markets, investments in emerging markets or single country debt or equity funds and investments in high yield or non-investment grade debt. Foreign securities may have additional material risks, depending on the specific risks affecting that country, such as: potential constraints on liquidity and the repatriation of funds; macroeconomic risks; political risks; foreign exchange risks; tax risks; settlement risks; and potential limitations on the availability of market information. Investment in the Fund may not be suitable for all investors. Investors should obtain advice from their financial adviser before proceeding with an investment. This document should be read in conjunction with the prospectus of MGF, in which all the current fees additional disclosures, risk of investment and fund facts are disclosed. This document should not be construed as an investment advertisement, or investment advice or guidance or proposal or recommendation in any form whatsoever, whether relating to the Fund or its underlying investments. It is for information purposes only and has been prepared and is made available for the benefit of the investors. While all care has been taken by the Investment Manager in the preparation of the information contained in this document, neither the Manager nor Investment Manager make any representations or give any warranties as to the correctness, accuracy or completeness of the information, nor does either the Manager or Investment Manager assume liability or responsibility for any losses arising from errors or omissions in the information.

Can equity markets continue their strong run?

Shaun le Roux and Mikhail Motala, Fund Managers at PSG Asset Management believe there’s scope for continued good returns from equities – but it will depend on where you are invested.

Not all equities are equal

While equities will be indispensable in client portfolios going forward, not all equities are equally well positioned to continue rewarding investors in the future. Owning the right equities will be key. Investors must look outside the popular areas of the market, with local equities specifically poised to offer some attractive opportunities.

Equities will have a key role to play in portfolios in a changing world

One of the key features of the new economic world order is that it will be marked by higher levels of global inflation. The monetisation of debt and ongoing fiscal deficits, especially when coupled with dovish monetary policy in the US, set the stage for a more inflationary environment.

Furthermore, rising protectionism will also add to existing inflation pressure, augmented by a weaker US dollar and tight labour markets. In such an environment, G7 (developed market) bonds are likely to be a poor store of value and equities will be essential to protecting investors’ wealth in the long run.

While equities are going to be needed to generate the appropriate real returns, certain sectors are unlikely to deliver the required returns. Real assets and precious metals typically fare well in more inflationary environments, while emerging markets benefit from weaker dollar cycles. However, we believe these equities are especially well positioned to reward investors into the future, as they are currently deeply out of favour and trading at far less rich valuations than their popular counterparts. A similar case can be made for global value stocks, which have been chronically trailing growth stocks for far longer than is typically the case in investment cycles.

In this article, we specifically look at the opportunity set we see in the local market.

Many investors are not positioned correctly to benefit from local equities going forward

Generally, shares perform well in inflationary environments, and from this perspective, the equity bull run for the year to date is understandable.

What is concerning, however, is that many investors’ portfolios have a disproportionate weighting to the US. This is partly a reflection of the exceptional returns US shares have delivered over the past few years. SA investors not only bought into this ‘US exceptionalism’ narrative, but have also tended towards being conservative in their allocation to local assets, seeing SA equities as ‘risky’ because of pessimism towards the local economic and political landscape.

Many investors have been surprised by the exceptional performance delivered by local equities so far this year. What investors have tended to lose sight of, is that the JSE is not representative of the SA economy. Some 54% of JSE Capped SWIX constituents are not SA Inc. companies. In fact, SA Inc. shares have lagged so far this year, while precious metals and commodities have done very well, buoying index returns. Deconstructing the 31% shows that gold miners contributed 14%, Naspers and Prosus 6%, platinum miners 6% and MTN 2%, meaning everything else in the index contributed 3%. SA Inc. shares outside of the banks, experienced particular pain.

Sources: PSG Asset Management and Bloomberg

The SA index’s appeal rises in a commodity bull market

Commodities are very influential in the South African economy and commodity stocks currently comprise 25% of the ALSI. Most investors have been bearish on commodities in recent years given the underperformance over much of the past decade – another reason why demand for SA equity funds has been lacklustre. PSG has a positive outlook on several commodities (including gold, PGMs, copper and coal), all of which are well represented in our market. In previous bull markets, resource stocks comprised in excess of 50% of the ALSI (in the 1970s and early 2000s). In the event of a new commodity bull market (which we think is quite likely over the next five years given the low level of additions to commodity capacity over the past decade) it is reasonable to expect strong relative performance from the JSE.

Overall, the SA market remains attractively priced

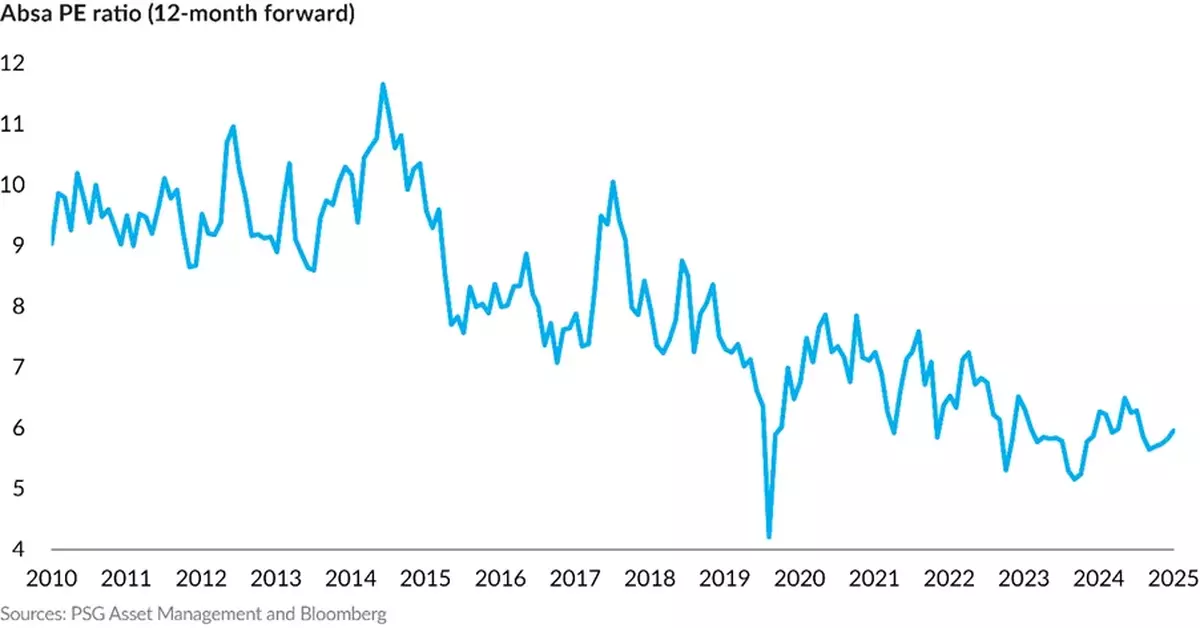

Despite the rally, many constituents of the South African market offer attractive value. The largest SA Inc. sectors are the banks, and across the banks, the cheapest one on traditional valuation metrics is Absa. Absa trades on a 6x PE and 8% dividend yield (not far removed from the yield currently received on the 10-year SA government bond, which has rallied sharply in recent months). The dividend per share has compounded by 7% p.a. over 15 years from 2010 to 2025, a period that has been tough for South Africa and where the term ’polycrisis’ was appropriate. If that dividend growth can be maintained, Absa offers a 15% total return absent any positive rerating in the PE ratio, which at a starting multiple of 6x carries a reasonable probability.

Undervaluation is not only evident in SA Inc. In the diversified mining sector, Glencore is also undervalued. The stock is trading at lows relative to the market, at similar levels to 2020, and has only been cheaper in 2015 when the balance sheet was much weaker than it is now.

The changing macro environment is likely to benefit emerging markets like SA

While no-one knows what the emerging global world order will ultimately look like, investors should be worried about continued positioning into some of the most expensive and crowded parts of the US markets, as it is highly unlikely that hype will be matched by economics in the long run. Importantly, valuations in SA equities are incredibly cheap compared to those in US markets, which are almost showing some bubble-like characteristics.

5 trends transforming retirement planning in 2026

For decades, retirement was a single moment. You worked, you stopped, and life after 60 followed a predictable script. That script is changing fast. Global population trends, new career patterns, and shifting attitudes to work are disrupting one of the most established ideas in personal finance. Retirement is becoming a transition, not a finish line.

As we move through 2026, the landscape of work and retirement continues its dramatic transformation. The question is no longer ‘when will you retire?’ but ‘what does retirement even mean anymore?’.

Here are the key trends transforming retirement planning in 2026.

1. The Grey Zone economy is rising

The space between full-time employment and complete retirement – what researchers call the “Grey Zone” – is becoming the new normal rather than the exception. In 2026, we’re seeing over-55s launching consultancies, turning hobbies into income streams, and taking on portfolio careers that blend passion with purpose.

This isn’t driven purely by financial necessity. Research shows people are resisting traditional retirement because it means losing identity, meaningful work, and social connection. The Grey Zone offers a solution: continued engagement without the pressure of a nine-to-five.

2. Gen Z’s multi-career reality requires new planning

Gen Z workers are now well into their careers, and the predictions are coming true: multiple job changes, diverse income streams, and non-linear career paths are the norm. By 2026, the average young professional has already had several employers, and each transition represents both opportunity and risk.

The risk? Every job change brings temptation to cash out retirement savings. Yet the compound growth lost from early withdrawals is staggering. Lawrence gives one example. Consider a 28-year-old with R50 000 in a retirement fund. It might be tempting to take the cash, as the tax payable seems small (about R4 000). However, if those funds were invested and grew at 8% a year until age 65, the amount would reach roughly R860 000 – 17 times the original value, lost if withdrawn too soon.

3. Longevity is rewriting the rulebook

With global life expectancy continuing to rise, money now needs to last 20 to 30 years beyond the traditional retirement age. By 2030, one in six people worldwide will be over 60 – a demographic shift that’s already forcing financial institutions and governments to rethink retirement frameworks.

The three-stage life model (learn, earn, retire) is obsolete. In its place: a fluid, multi-stage approach where people cycle between learning, earning, and transitioning throughout their lives.

4. Financial planning is personal coaching, not number-crunching

In 2026, the most successful financial planners function less like accountants and more like coaches. Think Rafael Nadal at his peak – even the greatest athlete needed someone to provide perspective, strategy, and accountability.

Financial guidance today means helping clients navigate career transitions, manage psychological resistance to retirement, and align money decisions with deeply personal values around purpose and identity says Lawrence.

5. The Democratisation of financial advice

The myth that “only wealthy people need financial planners” is finally dying says Lawrence. In 2026, financial guidance is recognised as essential at every life stage – whether you’re 25 and starting your first job, 40 and switching careers, or 55 and entering the Grey Zone.

With more career transitions, longer lifespans, and complex preservation decisions, everyone benefits from having a financial guide to help design a future that supports the life they want to live.

The 2026 takeaway

Retirement isn’t stopping anymore; it’s shifting, evolving, and becoming deeply personal. The Grey Zone is expanding, careers are multiplying, and longevity is creating both opportunities and challenges.

The winners in this new landscape will be those who plan proactively, preserve strategically, and view financial guidance not as a luxury but as an essential tool for navigating life’s transitions and money moments.

What’s shaping portfolios in 2026?

Foord Asset Management sizes up the forces set to sway markets next year.

Markets have spent much of 2025 rising with pockets of speculation emerging across asset classes. Asset prices almost everywhere – from Wall Street to Sandton – have floated higher on a breeze of optimism and a weaker dollar. As we approach a pivotal year for global growth, inflation, and monetary policy, Foord Asset Management reflects on what may matter most in the year ahead.