Want to Know Where Gold is Heading? Look at JP10Y!Want to Know Where Gold is Heading? Look at JP10Y!

+0.89 correlation: Did you know about this relationship between Japanese bonds and gold?"

One of the most overlooked indicators by gold investors is Japanese Government Bonds (JP10Y). When we examine the price movement over the past 5 years, a sur

The best trades require research, then commitment.

Get started for free$0 forever, no credit card needed

Scott "Kidd" PoteetPolaris Dawn astronaut

Where the world does markets

Join 100 million traders and investors taking the future into their own hands.

Doge and a BIG rise!Hi!

As shown on the chart, DOGE has clearly broken above the long-term descending trendline, which had been acting as resistance for several weeks. Following this breakout, price moved higher and confirmed the shift in market structure.

Importantly, the breakout was supported by a strong bullish e

Netflix Stock Dives as Crowds Reach for the Remote: Binge Over?Netflix NASDAQ:NFLX investors who hit play heading into the earnings were expecting a feel-good episode. Instead, they got a cliffhanger — and not the good kind.

Shares of the streaming giant are lower by about 5% pre-market Wednesday, even after the company posted better-than-expected fourth-qu

XAUUSD (GOLD) – 4-Hour Timeframe Tradertilki AnalysisGuys,

I have prepared a XAUUSD-Gold analysis for you on the 4-hour timeframe.

My friends, the levels of 4657.0 and 4599.0 are the best buy entry points.

When price reaches these levels, I will definitely open a buy position and aim for the following targets:

My targets:

1st Target: 4690.0

2n

Why Micron’s 26,000% Legacy is Just the BeginningWhy Micron’s 26,000% Legacy is Just the Beginning

To learn how to operate in the stock market it is interesting to stop thinking about money for a while and start understanding what is actually happening.

Today I bring you an example with NASDAQ:MU a company that in less than 20 years has of

Magnificent 7: a decisive short-term technical compressionCan the S&P 500 index avoid a corrective move back toward its former all-time high zone (6,150–6,200 points) after posting nine consecutive months of gains and trading at very demanding valuation levels? This is the central question for equity markets in the first quarter of 2026, and the answer lar

GOLD: Bullish! Buys Only! Buy The Dips!In this Weekly Market Forecast, we will analyze Gold (XAUUSD) for the week of Jan. 19-24th.

Gold is climbing higher, with Trump tariff threats as winds beneath the wings!

There is no reason to consider longs! Pullbacks should be seen as dip-buying opportunities.

It's that simple.

Enjoy!

May pro

MANA Ready for a Big Breakout! (4H)📈 MANA Price Analysis | Bullish Structure & Smart Money Perspective

The overall power and primary market direction of MANA (Decentraland) remain clearly bullish, indicating strong underlying demand and positive market sentiment. Recently, the price has experienced a sharp and aggressive corrective

Silvers easy route to $100.Silver is currently positioned with a clear and relatively uncomplicated path toward the $100/oz level, largely due to a visible price vacuum above current levels. From a market structure perspective, there are only a few major zones of resistance overhead, meaning price does not need to fight throu

GOLD - A long squeeze of support could trigger growthFX:XAUUSD continues to consolidate, Friday's long squeeze (false breakdown) of support provides an opportunity for growth amid geopolitical issues...

The dollar is strengthening against the backdrop of Thursday's economic data and Trump's geopolitical actions, but against this backdrop, gold i

See all editors' picks ideas

Volume Cluster Profile [VCP] (Zeiierman)█ Overview

Volume Cluster Profile (Zeiierman) is a volume profile tool that builds cluster-enhanced volume-by-price maps for both the current market window and prior swing segments.

Instead of treating the profile as a raw histogram only, VCP detects the dominant volume peaks (clusters) insid

DeeptestDeeptest: Quantitative Backtesting Library for Pine Script

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

█ OVERVIEW

Deeptest is a Pine Script library that provides quantitative analysis tools for strategy backtesting. It calculates over 100 statistical metrics including risk-adjusted return ratios (Sharpe

Arbitrage Detector [LuxAlgo]The Arbitrage Detector unveils hidden spreads in the crypto and forex markets. It compares the same asset on the main crypto exchanges and forex brokers and displays both prices and volumes on a dashboard, as well as the maximum spread detected on a histogram divided by four user-selected percenti

Multi-Distribution Volume Profile (Zeiierman)█ Overview

Multi-Distribution Volume Profile (Zeiierman) is a flexible, structure-first volume profile tool that lets you reshape how volume is distributed across price, from classic uniform profiles to advanced statistical curves like Gaussian, Lognormal, Student-t, and more.

Instead of forcin

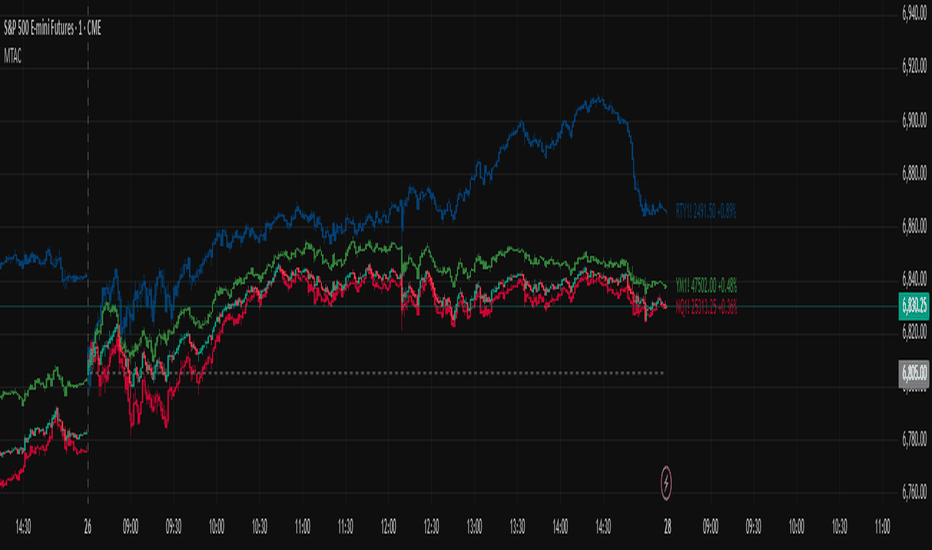

Multi-Ticker Anchored CandlesMulti-Ticker Anchored Candles (MTAC) is a simple tool for overlaying up to 3 tickers onto the same chart. This is achieved by interpreting each symbol's OHLC data as percentages, then plotting their candle points relative to the main chart's open. This allows for a simple comparison of tickers to tr

Vdubus Divergence Wave Pattern Generator V1The Vdubus Divergence Wave Theory

10 years in the making & now finally thanks to AI I have attempted to put my Trading strategy & logic into a visual representation of how I analyse and project market using Core price action & MacD. Enjoy :)

A Proprietary Structural & Momentum Confluence System

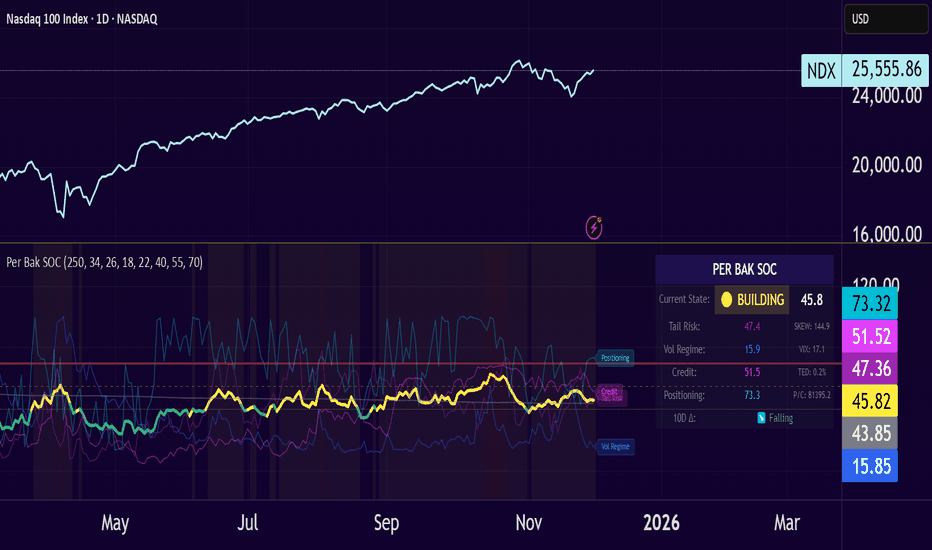

Per Bak Self-Organized CriticalityTL;DR: This indicator measures market fragility. It measures the system's vulnerability to cascade failures and phase transitions. I've added four independent stress vectors: tail risk, volatility regime, credit stress, and positioning extremes. This allows us to quantify how susceptible markets are

Volatility Risk PremiumTHE INSURANCE PREMIUM OF THE STOCK MARKET

Every day, millions of investors face a fundamental question that has puzzled economists for decades: how much should protection against market crashes cost? The answer lies in a phenomenon called the Volatility Risk Premium, and understanding it may fundam

Volume Gaps & Imbalances (Zeiierman)█ Overview

Volume Gaps & Imbalances (Zeiierman) is an advanced market-structure and order-flow visualizer that maps where the market traded, where it did not, and how buyer-vs-seller pressure accumulated across the entire price range.

The core of the indicator is a price-by-price volume prof

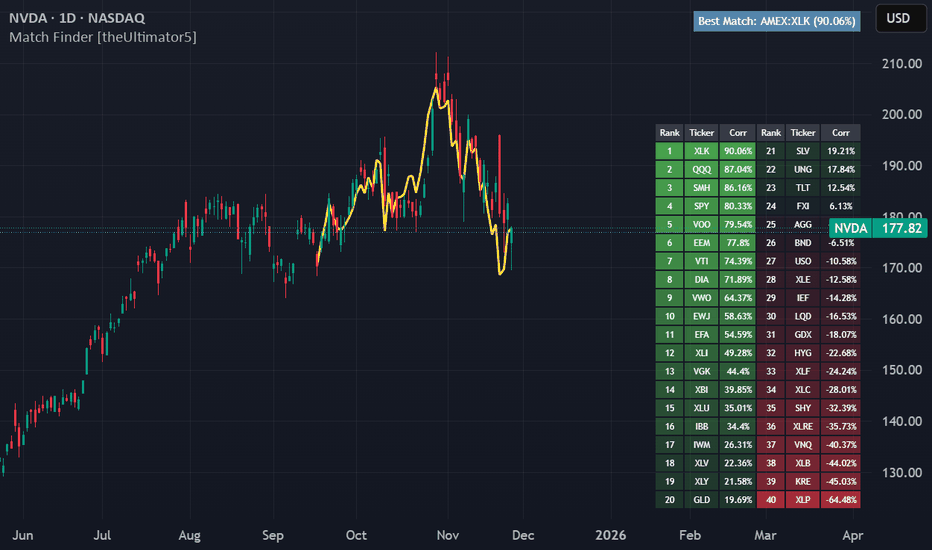

Match Finder [theUltimator5]Match Finder is the dating app of indicators. It takes your current ticker and finds the most compatible match over a recent time period. The match may not be Mr. right, but it is Mr. right now. It doesn't forecast future connection, but it tells you current compatibility for today.

Jokes aside,

See all indicators and strategies

Community trends

AMAZON Can it correct to $150?Amazon (AMZN) has stalled its massive rally since the April 2025 Low as since November 03 it has been unable to make a new All Time High (ATH). That is because that day it hit a key Resistance, its 5-year Higher Highs trend-line, technically the top of its long-term Channel Up.

The resulting correc

Nvidia - This stock remains quite weak!🔮Nvidia ( NASDAQ:NVDA ) could still drop about -20%:

🔎Analysis summary:

While the entire stock market is heading for new all time highs, Nvidia is still consolidating. Considering the recent retest of the major resistance trendline, Nvidia remains quite weak. Maybe we will even see a short te

AI Semis: Momentum vs. Mean Reversion, What Wins in 2026?Looking at this relative performance chart of AI / semiconductor stocks over the past year.

INTC and AMD massively outperformed, while other names in the space (AVGO, NVDA, QCOM, MRVL) lagged or moved much more slowly.

Now I’m genuinely debating the next move for a 12 month trade:

Does it make se

TSLA D1 Institutional Buy/Sell Levels by ProjectSyndicate 🔱 TSLA DAILY SNAPSHOT — EXECUTIVE SUMMARY (NEW WEEK | JAN 2026)

✨ Dip-accumulation reversal setup is the focus — but upside is capped until overhead sell-side is cleared

🧲 Fresh overhead sell-side liquidity / fresh supply: 495 plus key level 460

📌 Context: price is range-bound between fresh supply

NVO BEARISH TO BULLISHNVO forming a potential reversal setup: currently showing signs of transitioning from bearish to bullish. Looking for confirmation of trend change before entering long.

the confirimation would be seeing nvo breaking the current resistence

also, sidenote, SMA 150 AND SMA 20 have crossed, thats a goo

$CRWV, when I was working at a trading firm I had a conversationNASDAQ:CRWV , when I was working at a trading firm I had a conversation behind closed doors every single time I lost a large open profit. Yesterday, CoreWeave reminded me of this.

I still chose to stay fully positioned after seeing price follow the path I had mapped out on the chart three days ago

About seasonalityI was looking at Fortinet (FTNT) seasonality and noticed something interesting when comparing two different approaches.

TradingView’s seasonality view is great to visually inspect how individual years behaved. You can clearly see the dispersion between strong and weak years.

In parallel I ran the

$RKT Elliott Wave Setup — Wave (3) of 5 LoadingNYSE:RKT

Elliott Wave Setup — Wave (3) of 5 Loading

Daily | $21.65

Count:

✅ (1) Complete — Nov

✅ (2) Complete — ABC to $17

🔄 (3) In Progress → $29-30

📍 (4) Projected → $23-24

🎯 (5) Terminal → $39.60

Levels:

❌ $17.00 — Invalidation

⚠️ $21.41 — Channel support

📍 $21.65 — Current (0.5 fib)

🔼 $24.88 —

More than doubleAfter the previous idea, which concluded successfully, I am coming back to Moderna, which is included among the BIOTECH stocks I am following most closely.

Some background information:

Moderna is first and foremost a research‑driven biotechnology company, not a traditional, mature pharmaceutical fi

See all stocks ideas

Today

BAHBooz Allen Hamilton Holding Corporation

Actual

—

Estimate

1.29

USD

Today

ISTRInvestar Holding Corporation

Actual

0.51

USD

Estimate

0.53

USD

Today

BHBBar Harbor Bankshares, Inc.

Actual

0.90

USD

Estimate

0.90

USD

Today

SLBSLB Limited

Actual

—

Estimate

0.74

USD

Today

RVSBRiverview Bancorp Inc

Actual

—

Estimate

0.04

USD

Today

MOFGMidWestOne Financial Group, Inc.

Actual

—

Estimate

0.87

USD

Today

FMNBFarmers National Banc Corp.

Actual

—

Estimate

0.47

USD

Today

PCBPCB Bancorp

Actual

—

Estimate

0.60

USD

See more events

Community trends

BTCUSDT - The battle for 90K may end in a decline BINANCE:BTCUSDT , against the backdrop of Trump's speech and various comments, caused a shake-up within the range of 87,800-90,300, but the price is consolidating below key resistance within the current downtrend...

The downtrend may continue if Bitcoin consolidates below 90K. There is a chanc

Bitcoin - The most important analysis you've ever seen!In this very detailed and unique analysis, we will look at the most important Bitcoin fundamental analysis of halving cycles. I predict Bitcoin will crash to 49k or 60k in 2026, so if you are buying now for the long term as an investment (buy and hold), you can probably wait for a better price! We c

BTC - The Last Standing Checkpoint!This blue zone is the line in the sand.

Right now, BTC is sitting at a critical checkpoint, where multiple reactions already took place. As long as this blue demand zone holds, the plan remains simple:

👉 Look for longs, in line with a potential continuation toward the upper bound of the structure.

BTCUSD BUY ZONE ACTIVATED | Cloud Support Holding Upside TargetBitcoin is showing signs of a short-term recovery after a strong sell-off. Price is currently holding near a key demand zone around 89K, while trading below the Ichimoku cloud — indicating the broader trend is still bearish, but a technical bounce is possible.Market Structure: Overall structure rema

BTCUSDT Short: Lower Highs, Supply Rejection & Demand in FocusHello traders! Here’s a clear technical breakdown of BTCUSDT (2H) based on the current chart structure. Bitcoin previously traded within a broader bullish recovery phase, supported by a rising trend line that guided price higher from the lows. During this advance, BTC formed a consolidation range, r

BTCUSDT: Breakdown Confirmed – Sellers in Control, Target to 87KHello everyone, here is my breakdown of the current BTCUSDT setup.

Market Analysis

BTCUSDT previously traded within a bullish structure, supported by a well-defined ascending trend line that reflected strong buyer control. After an impulsive upward move, price formed a consolidation range near th

BITCOIN / GOLD ratio's mind-blowing revelation.Bitcoin (BTCUSD) remains under heavy pressure since its October 2025 All Time High (ATH) but the BTC/GOLD ratio reveals that the real selling pressure in terms of the precious yellow metal has been boiling up for some time before that date.

In fact the ratio's last High was in August 2025, which te

Is Bitcoin about to crash? Read in full...Bitcoin is very slow lately and the same price range has been holding for months, no change truly. Normally, even while we recognize all of the signals and keep a bullish bias, it is still normal to wonder if Bitcoin will continue growing.

The active price range is the same since late November. Bit

ZEC has started a bearish wave (12H)From the point where we placed the red arrow on the chart, it appears that ZEC is forming an ABC correction or potentially a more complex corrective structure. Based on the current price action, wave B seems to have completed, and we are now in the early stages of a bearish wave C.

All the upward r

See all crypto ideas

Gold (XAUUSD) – Technical Analysis | Market StructureFrom a technical standpoint, gold continues to trade within a structurally sound bullish environment. Price action maintains a clear sequence of higher highs and higher lows, indicating that the broader upward structure remains intact.

Recent pullbacks have been controlled and shallow, suggesting c

GOLD: Profit-Taking Risk in Gold as Geopolitical Tensions EaseGOLD: Profit-Taking Risk in Gold as Geopolitical Tensions Ease

Yesterday in Davos:

U.S. President Donald Trump abruptly stepped back on Wednesday from threats to impose tariffs as leverage to seize Greenland, ruled out the use of force and suggested a deal was in sight to end a dispute over the

GOLD - Pullback before growth after Asian momentum FX:XAUUSD is correcting after hitting a historic high ($4,900), due to the de-escalation of tensions between the US and the EU. Profit-taking is observed, but the trend remains bullish...

Fundamental background:

- Trump has cooled down: tariffs are temporarily suspended, as is the forceful s

Gold 30Min Engaged ( Bullish Reversal Entry Detected )⚡Base : Hanzo Trading Alpha Algorithm

The algorithm calculates volatility displacement vs liquidity recovery, identifying where probability meets imbalance.

It trades only where precision, volume, and manipulation intersect —only logic.

Technical Reasons

/ Direction — LONG / Reversal 4819 Area

☄️B

XAUUSD Ascending Channel Holds, Upside Toward $4,950Hello traders! Here’s my technical outlook on XAUUSD (1H) based on the current chart structure. Gold is trading within a well-defined bullish structure, supported by a rising price channel formed after a clear shift in market control from sellers to buyers. Earlier on the chart, price respected the

Hellena | GOLD (4H): LONG to 50% Fibo 4933.Colleagues, the price continues its upward movement in wave “5” of the higher order (red wave), and a major correction is already quite close, but we need to understand where the upward momentum will end.

I believe that the price will renew its maximum and rise to the 50% Fibonacci extension level t

XAUUSD(GOLD): Price is likely to be heading towards $4950! Gold corrected after reaching a record high of $4880. We anticipated further drops but recent geopolitical tensions have disrupted the natural price trend. Consequently, there’s a strong chance the price will move towards the $5000 area.

We’ve set up two entries – one riskier and one safer – so c

Lingrid | GOLD Approaching Most Significant Level in HistoryOANDA:XAUUSD perfectly played out my previous trading idea . The market is pressing into the upper boundary of its long-term ascending channel as price nears the psychological 5,000 zone, an area that aligns with major historical resistance. It continues to respect its rising channel structure, wi

XAUUSD: Holds $4,770 Support With Upside Potential Toward $4,890Hello everyone, here is my breakdown of the current XAUUSD setup.

Market Analysis

Gold is trading within a well-defined bullish structure, supported by a clear ascending channel that reflects sustained buyer control. Earlier in the move, price respected the lower boundary of the channel and forme

XAUUSD | 30M – Bullish Continuation After Demand RetestOANDA:XAUUSD

Gold remains structurally bullish after a strong upside expansion. The recent pullback into demand was met with immediate buying interest, suggesting institutional participation. As long as price holds above the marked demand zone, continuation toward higher resistance levels remains

See all futures ideas

EURUSD Rejection From Resistance, 1.1630 Support in FocusHello traders! Here’s my technical outlook on EURUSD (4H) based on the current chart structure. EURUSD previously traded within a well-defined bullish channel, supported by a rising trend line and a sequence of higher highs and higher lows. This structure confirmed strong buyer control after price r

EURUSD is showing early signs of bullish reversalEURUSD Price respected a descending channel for a long time, making lower highs and lower lows. Recently, strong bullish momentum pushed price out of the lower side of the channel, signalling possible trend reversal or at least a corrective upside move.

Current price is consolidating around 1.1700,

EURUSD Long: Buyers Step In After Bearish Structure FailsHello traders! Here’s a clear technical breakdown of EURUSD (4H) based on the current chart structure. EURUSD previously experienced a corrective bearish phase, trading inside a descending channel after forming a rounding top near the highs. However, this bearish structure has recently weakened. Pri

TheGrove | GBPCAD SELL | Idea Trading AnalysisGBPCAD broke down sharply from the rising channel, confirming a bearish. the impulsive sell-off invalidated prior bullish structure and pushed price below key intraday supports.

GBPCAD is moving on Resistance area..

The chart is above the support level, which has already become a reversal point twic

EURUSDHello Traders! 👋

What are your thoughts on EURUSD?

After a correction, price reached a key support zone and the ascending trendline, where it found strong buying interest. We are now witnessing a clear breakout of the descending trendline, confirming a shift in short-term market structure and a su

EURGBP - It is just a correction for nowEURGBP has been bearish, trading cleanly inside a falling red channel.

After the recent bounce, price is now retesting the upper bound of that channel, and more importantly, this area lines up with a clear red structure zone. This kind of confluence is exactly where corrective rallies tend to run o

AUDUSD Outlook | Uptrend Holds as Gold Supports AUD!Hey Traders,

In today’s trading session, we are closely monitoring AUDUSD for a potential buying opportunity around the 0.67600 zone. AUDUSD remains in a well-established uptrend and is currently undergoing a healthy corrective pullback, approaching a key trendline confluence and the 0.67600 suppor

EURUSD: A Pullback to 1.1680 is Planned Before Further GrowthHello everyone, here is my breakdown of the current EURUSD setup.

Market Analysis

EURUSD previously traded within a well-defined upward channel, confirming a bullish recovery phase with higher highs and higher lows. During this advance, price respected the rising support line and produced several

NZDCAD: Structure AnalysisNZDCAD: Structure Analysis

NZDCAD has broken out of a strong daily structure area located near 0.8060.

This is a key area for NZDCAD as it has been weak since early October.

The strange thing is that NZD is getting stronger without any news to support the move.

From a technical perspective, if N

See all forex ideas

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - |

Trade directly on Supercharts through our supported, fully-verified, and user-reviewed brokers.