Benchmark Canadian oil and gas with vital financial, operating and asset data.

Evaluate key performance metrics for Canadian operators and inform your models and workflows, via a web-based platform and the cloud.

Overview

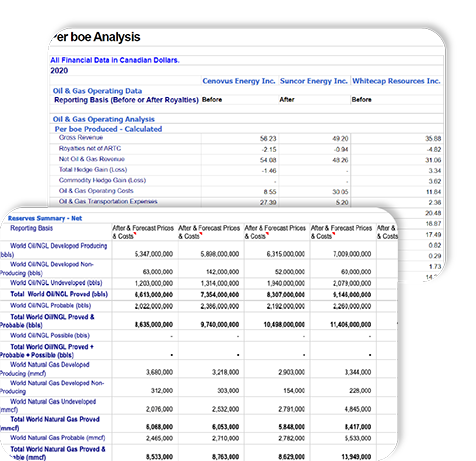

Deepen your assessment of Canadian oil and gas company performance using essential financial and operating metrics within our CanOils database.

Use CanOils to improve your internal workflows and incorporate a full analysis of cost efficiencies, investment risk and asset performance, and track efforts by companies in the Western Canadian Sedimentary Basin to diversify and rationalize portfolios.

Compare and benchmark Canadian company revenue, assets, reserves, production, operating costs, cash-flow, capital spending, deals and hedging – all via a user-friendly web platform and the cloud.

Key features

Financial analysis

Valuations, debt, liquidity and credit.

Cash flow, capital structure, capex, hedging.

Upstream capital raisings including private placements and prospectus offerings.

Earnings, dividends and shareholder returns.

Operational analysis

Canadian asset performance.

Production, 1P, 2P reserves, drilling, NPV from regulatory releases.

Price realizations, margins and netbacks.

Costs per boe for production, F&D, FD&A.

Refinery costs, throughputs, capacities and production.

Guidance on capital spending, production, drilling.

M&A deal coverage

Every Canadian oil and gas deal.

Upstream, midstream, refineries, oil service: Cost per boe produced, 1P, 2P reserves.

Renewables: Wind, Solar, EV, Geothermal, Hydrogen, CCUS, Biofuel including capacity, cost per MW.

Full financial consideration breakdown for each deal.

Typical users

Upstream oil and gas companies

Oil service and downstream suppliers

Business analysts

Banking and financial service providers

See CanOils in action

CanOils contains a number of vital workflows that can improve your productivity. Demonstrations are available from our Canadian analysts to answer any questions you may have.