日本人(正確には本邦居住者)の新規口座開設や追加投資までもがお断りとなってからも、その商品性の良さからフレンズプロビデントのプレミアを継続して積み立てている投資家も多いと思います。

日本人(正確には本邦居住者)の新規口座開設や追加投資までもがお断りとなってからも、その商品性の良さからフレンズプロビデントのプレミアを継続して積み立てている投資家も多いと思います。もっとも、自称IFAとか言われているところに口座を置いていてもパフォーマンスは決して出ません。しっかりと代理店移管をして、年間1%という法外な一任勘定手数料(アドバイザーへのマネジメントフィー)を省かないと、せっせと積み立てたところで元は取れないからです。

ここでは、そんな業者から決別して代理店移管などを決行して、ご自身で維持管理しながら積み立てを続けている投資家へ記事を書いています。まだ、移管して自由なオフショア投資を満喫できていないからは、こちらからお問い合わせください。

ということで、今日は、フレンズプロビデント投資家が常々、ミラーファンドが運用終了されたり、新しいファンドができたりする上場をどうやって入手するかをお伝えします。

Notification of changes to the underlying funds of L60 Fidelity US Dollar Cash Fund and L62 Fidelity Euro Cash Fund

29 Jun 2022

We have been notified by Fidelity International (the “Company”) of the following changes which impact the Fidelity Funds – US Dollar Cash Fund and Fidelity Funds - Euro Cash (together the “Underlying funds”), which are the underlying funds of the following mirror funds:

- L60 Fidelity US Dollar Cash Fund

- L62 Fidelity Euro Cash Fund

("together the Affected Mirror Funds")

Re-classification from Article 6 to Article 8

The Company has conducted a thorough analysis of the investment policy and investment process of the Underlying funds, and has decided that with effect from 16 August 2022 (the “Effective Date”), the Company will re-classify the Underlying funds to Article 8 (“Re-classification”) under Regulation (EU) 2019/2088 on sustainability-related disclosures in the financial services sector (“SFDR”), in accordance with Fidelity’s Sustainable Investing Framework (as detailed in the Underlying funds prospectus).

Implication of the changes

Following the Re-classification, the English names of the Underlying funds will be amended to include the word Sustainable, and their investment objectives will be enhanced with further sustainability-related disclosures regarding the promotion of environmental and social characteristics pursuant to Article 8 of the SFDR. However, the enhanced disclosures do not represent a material change to the investment strategy or investment policy of the Underlying funds.

Additionally, there will be no change in the fee level or costs of the repurposed Underlying funds, following the implementation of the changes detailed in this notice. The costs and/or expenses incurred in connection with the changes detailed in this notice will be borne by FIL Fund Management Limited, the Investment Manager (and/or any of its affiliates within FIL Group) of the Underlying funds of the Affected Mirror funds.

In line with the above changes to the Underlying funds, the name and investment objective of each Affected Mirror Fund will be amended as follows:

| Before the Effective Date | After the Effective Date | |

| Affected Mirror Fund 1 name | L60 Fidelity US Dollar Cash Fund | L60 Fidelity Funds Sustainable US Dollar Cash (USD) |

| Affected Mirror Fund 1 investment objective | The fund invests principally in US Dollar denominated Money Market Instruments, reverse repurchase agreements and deposits. The fund is actively managed without reference to an index. | The fund invests principally in US Dollar denominated Money Market Instruments, reverse repurchase agreements and deposits. The fund is part of the Fidelity Sustainable Family of Funds and adopts a Sustainable Focused strategy under which a minimum of 70% of the fund’s net assets will be invested in securities deemed to maintain sustainable characteristics, as described in the section entitled “1.3.2 (b) Fidelity Sustainable Family of Funds” of the Underlying fund’s Prospectus. The fund is actively managed without reference to an index. |

| Before the Effective Date | After the Effective Date | |

| Affected Mirror Fund 2 name | L62 Fidelity Euro Cash Fund | L62 Fidelity Funds Sustainable Euro Cash (EUR) |

| Affected Mirror Fund 2 investment objective |

The fund invests principally in Euro denominated Money Market Instruments, reverse repurchase agreements and deposits. The fund is actively managed without reference to an index. | The fund invests principally in Euro denominated Money Market Instruments, reverse repurchase agreements and deposits. The fund is part of the Fidelity Sustainable Family of Funds and adopts a Sustainable Focused strategy under which a minimum of 70% of the fund’s net assets will be invested in securities deemed to maintain sustainable characteristics, as described in the section entitled “1.3.2 (b) Fidelity Sustainable Family of Funds” of the Underlying fund’s Prospectus. The fund is actively managed without reference to an index. The fund invests principally in US Dollar denominated Money Market Instruments, reverse repurchase agreements and deposits. The fund is part of the Fidelity Sustainable Family of Funds and adopts a Sustainable Focused strategy under which a minimum of 70% of the fund’s net assets will be invested in securities deemed to maintain sustainable characteristics, as described in the section entitled “1.3.2 (b) Fidelity Sustainable Family of Funds” of the Underlying fund’s Prospectus. The fund is actively managed without reference to an index. |

シュローダーのファンドについては、日本の銀行や証券会社の窓販で買えるものも多いのですが、やっぱりロンドン上場の英系大手運用会社

シュローダーのファンドについては、日本の銀行や証券会社の窓販で買えるものも多いのですが、やっぱりロンドン上場の英系大手運用会社

American Funds (American Funds Distributors, Inc) というブランド名で有名な、

American Funds (American Funds Distributors, Inc) というブランド名で有名な、

J.P. Morgan Asset Management

J.P. Morgan Asset Management

USD371Bという超巨額な預かり資産を有する大手運用会社

USD371Bという超巨額な預かり資産を有する大手運用会社

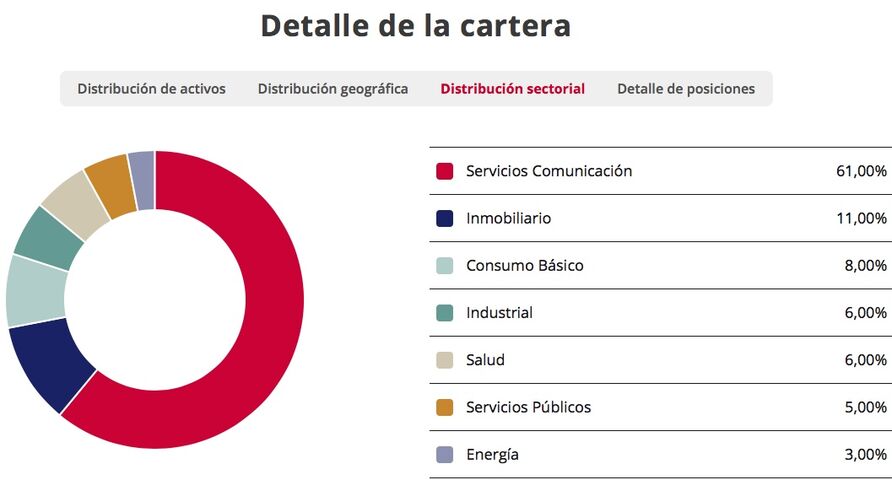

2001年にスペインのマドリードで創業した独立系の運用会社、アバンテ

2001年にスペインのマドリードで創業した独立系の運用会社、アバンテ

2011年に南アフリカのケープタウンで創業した、

2011年に南アフリカのケープタウンで創業した、

1978年にロンドンで創業し、今では

1978年にロンドンで創業し、今では

1991年にロンドンで創業した、First Trust Portfolios L.P. と First Trust Advisors L.P.の運用会社グループ。複数のページにわたって、ちょっと数えるのは骨が折れるほどのかなりの数のETFを組成しています。

1991年にロンドンで創業した、First Trust Portfolios L.P. と First Trust Advisors L.P.の運用会社グループ。複数のページにわたって、ちょっと数えるのは骨が折れるほどのかなりの数のETFを組成しています。

預かり資産GBP388Bという大手

預かり資産GBP388Bという大手

Ninety One plc

Ninety One plc

1987年創業、オーストラリアの上場保険会社、

1987年創業、オーストラリアの上場保険会社、 Matthews International Capital Management

Matthews International Capital Management

ご存知、超大手金融グループ、BNPパリバ銀行グループの運用会社、

ご存知、超大手金融グループ、BNPパリバ銀行グループの運用会社、